Ready to launch your own podcast? Book a strategy call.

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Conversation

Highlights

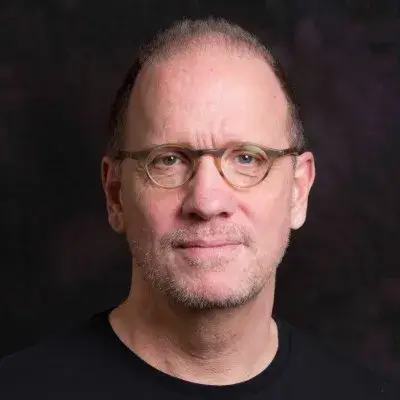

From Hardware Sales to SaaS: How GroGuru’s Patient GTM Strategy Led to 10x ARR Growth

Building trust takes time, especially when your customers’ livelihoods depend on your technology working flawlessly. In a recent episode of Category Visionaries, Patrick Henry shared how GroGuru transformed from a hardware-first business into a thriving subscription service by taking the long view on customer relationships.

The Trust-First Approach

When most founders talk about going to market, they focus on rapid scaling and immediate revenue growth. But Patrick took a different path with GroGuru, recognizing that in agriculture, trust precedes transactions.

“Any system that they use this in agriculture technology or an ag tech product, in order for them to use it, they got to trust it,” Patrick explains. “For them to trust it has to be highly reliable, and there has to be a trusted advisory network that stands behind it.”

This insight shaped GroGuru’s entire go-to-market strategy. Rather than pushing their ideal business model immediately, they started with traditional hardware sales paired with software subscriptions. “We always had the intent to sell hardware as a service,” Patrick reveals, “But as we’re building the trust and the relationship with the farmers, we initially sold the hardware, and then we had annual software subscription.”

Building the Trust Network

Instead of trying to build credibility from scratch, GroGuru leveraged existing relationships in the agriculture industry. “We look within region and we look for people that really have significant market domain expertise and relationships within that market. So it kind of jump starts the trust,” Patrick shares.

This strategy extended beyond just sales channels. Patrick emphasizes the importance of strategic partnerships: “Having the right partners that have domain expertise and really core competencies in key areas that you don’t becomes very important to build complete system solutions.”

The Pivot Point

A crucial strategic decision came when Patrick shifted the company’s focus away from California’s perennial crops. Despite the Silicon Valley attention on California water issues, Patrick recognized a bigger opportunity: “You get so much noise around water issues in California… and you could miss the bigger market opportunity, which is row in the midwest, where they also have significant water issues and portions of that market.”

The Patience Pays Off

After five growing seasons of proven performance, GroGuru had built enough trust to transition to their intended business model. The results were dramatic: “Our revenue this year, we’re expecting it to over four x versus last year, but our recurring revenue or annual recurring revenue, well, more than ten x.”

Navigating Today’s Funding Landscape

Patrick’s experience raising capital reveals how the venture landscape has evolved. “Most of those funds up there now, these mega, billion dollar, multi billion dollar funds, they have to write 30, 50, 100 million dollar checks to be able to move the needle on their fund. And that’s not early stage investing, that’s growth stage investing.”

This reality forced GroGuru to get creative with funding. They combined angel investments, technology incubator programs, and even equity crowdfunding during market downturns. The key lesson? “You got to be flexible, you got to be creative, and you got to be willing to just grind it out.”

The Reality Check

For founders considering the entrepreneurial path, Patrick offers a sobering perspective: “I always recommend against anybody starting a company, and they’ve got to fight me to try to start it because it’s so hard… You work at a big company, you got a lot of people around you that can support you. And entrepreneurship. You don’t have that. I’d say, you know, a small company is like one person doing six jobs, and then in a big company, it’s like six people doing one job.”

GroGuru’s journey illustrates that sometimes the path to rapid growth requires patience. By prioritizing trust-building over immediate revenue optimization, they’ve positioned themselves to transform how farmers think about water management. For B2B founders, especially those entering traditional industries, it’s a masterclass in playing the long game.

Actionable

Takeaways

Leverage Diverse Experiences for Innovation:

Patrick’s transition from tech to AgTech underscores the value of applying cross-industry experience to solve global challenges like sustainable agriculture. Founders should explore how their unique skills and backgrounds can address pressing issues.

Build Resilience and Adaptability:

The story of navigating startup challenges during external crises like 9/11 illustrates the necessity of being prepared for unforeseen events. Develop strategies that allow your business to remain flexible and resilient in the face of such challenges.

Understand the Implications of an IPO:

Patrick’s insights into the complexities of going public serve as a valuable lesson for founders considering this path. It’s crucial to understand that an IPO represents a significant shift in company dynamics and founder responsibilities.

Prioritize Cultural Fit in Acquisitions:

Patrick’s experiences with acquisitions highlight the importance of ensuring cultural and strategic alignment. Small, strategic acquisitions can enhance your company's capabilities without diluting its core mission or culture.

Emphasize Ease of Use and Trust in Product Development:

In markets like AgTech, where technology adoption can be challenging, focusing on building reliable, user-friendly solutions is key. Establishing trust through a network of trusted advisors can significantly enhance technology uptake among target users.