Ready to launch your own podcast? Book a strategy call.

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Conversation

Highlights

From Skepticism to Standard: Building an AI Company Before the Hype

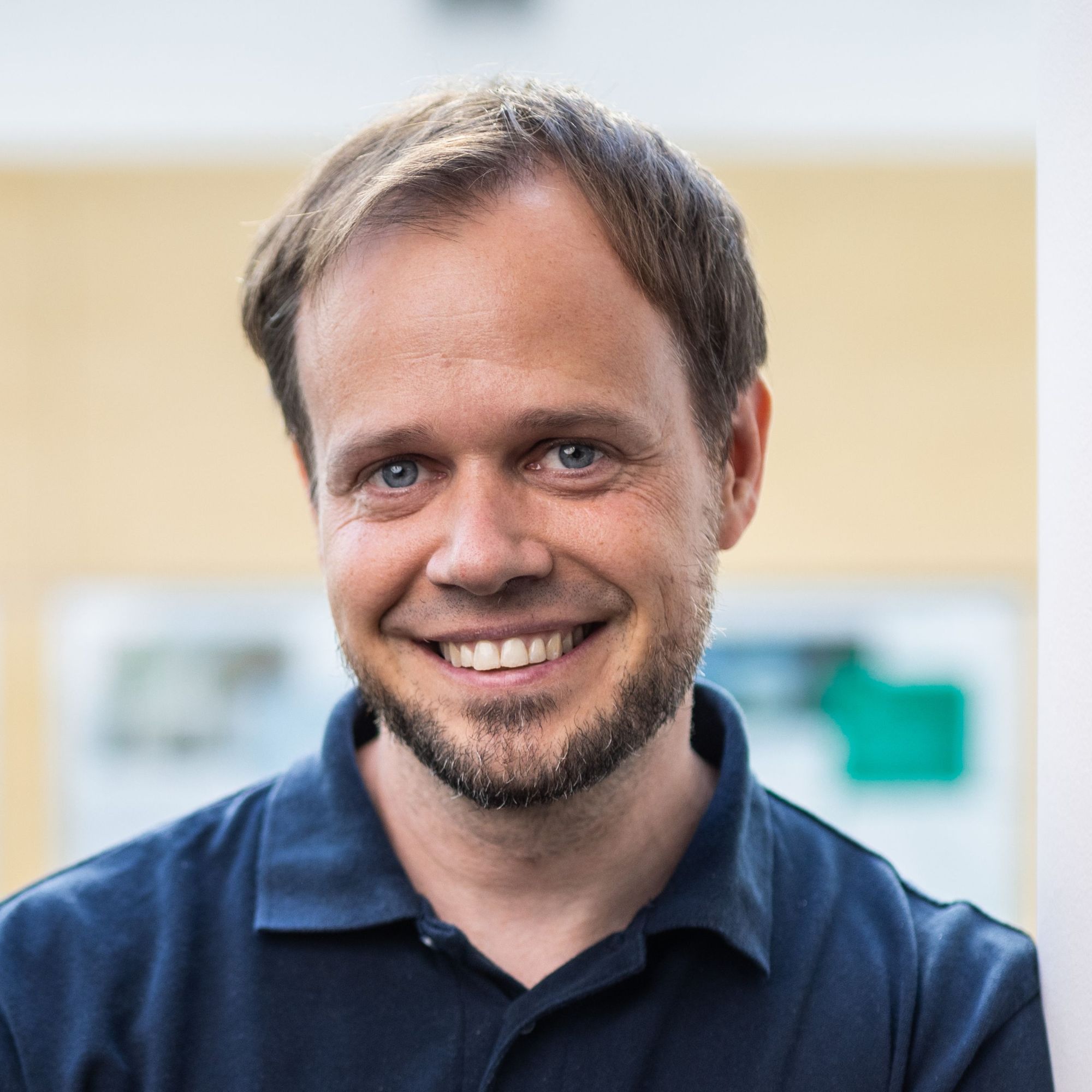

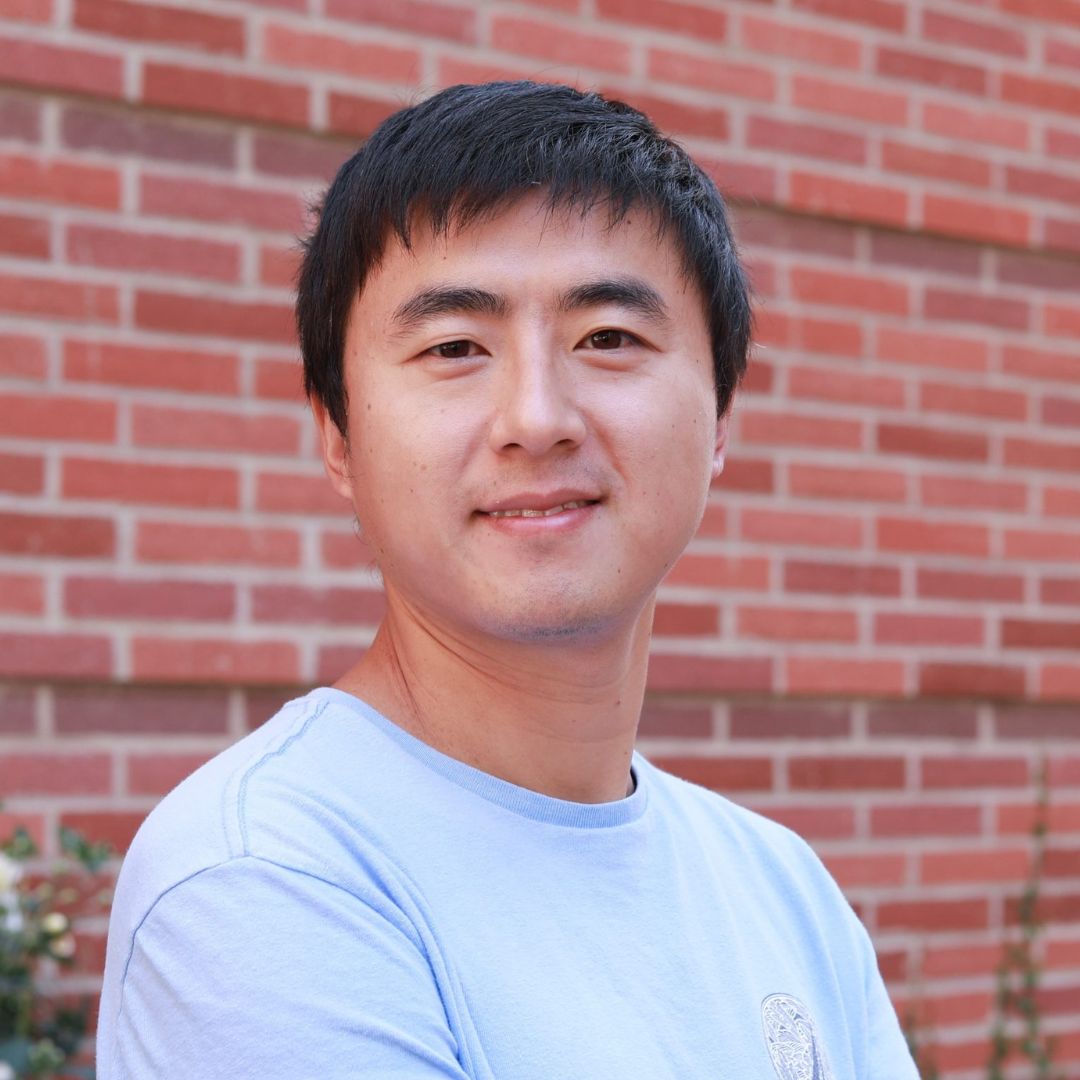

Eight years ago, mentioning AI to financial institutions was met with blank stares and basic questions. “The first question we always got was very simple, what is AI? And what AI means in your name?” recalls Daniele, founder of Axion AI, in a recent Category Visionaries episode. Today, every company claims AI capabilities, but Axion’s early bet on deep learning for financial markets offers valuable lessons in building trust and credibility in emerging technology markets.

When Axion launched in 2016, they weren’t just fighting technical challenges – they were battling the ghosts of AI’s past. “We had to recover the dissatisfaction and disillusionment that the industry had from previous hypes in AI,” Daniele explains. The industry remembered AI’s previous failed promises from the 80s and 90s, when computational power couldn’t match the vision.

This skepticism shaped Axion’s entire go-to-market approach. Rather than chase quick wins, they built for the long game. As Daniele recalls, “A very successful ex startup founder who became millionaire told me, yeah, you are getting into a ten year business. This will not be a short ride.”

The foundation of their strategy rested on two pillars. First, unwavering technical excellence: “You cannot really sell smoke, okay? Because yeah, if you sell small and you ride the hype, then you may have short term success, but then if your reputation gets a hit, you’re done.”

Second, they focused on building a track record through strategic collaborations. This meant starting small and proving their value before scaling. For early credibility, they joined ING’s acceleration program in Amsterdam, which led to both investment and crucial industry introductions. UniCredit later joined as their second major investor, further validating their approach.

But perhaps their most impactful move was bringing on industry heavyweights as advisors. “I think it is very important for a startup to get sort of sponsorship from relevant person in the industry they’re selling to,” Daniele notes. They secured advisors like the president of Work Wand and former Goldman Sachs co-head of Quant, giving them the pedigree needed to open doors in conservative financial institutions.

This careful cultivation of trust proved crucial because, as Daniele explains, “In the financial sector, the stakes are high. And in large institutions, sometimes it’s better for the people working in it not to make mistakes rather than go beyond expectations in terms of performance.”

Rather than trying to be everything to everyone, Axion maintained laser focus on investment management, specifically in adding alpha to investment strategies. This specialization helped them build deep expertise that generalist AI companies couldn’t match. When competitors emerged, Axion’s focused experience set them apart: “When we find competitors or other companies like pitching, maybe the same prospect, they often are not as focused as us, not as technology and value focused as us, and not scientifically sound and with a long track record as us.”

Today, their challenge isn’t convincing people about AI’s potential – it’s standing out in an increasingly noisy market. “The biggest problem from us in terms of competition are not other companies that say, are serious players in Syria, but more the, let’s say the smoke again, AI smoke that is out there because now every company says they are doing some kind of AI.”

Looking ahead, Daniele predicts AI will become table stakes in investment management: “In five years, AI would be an essential and core component of any investment strategy… It would not just be a matter of like having AI to get energy, would be a matter of having AI to stay in the game.”

For founders building in emerging technologies, Axion’s journey offers valuable lessons: technical excellence alone isn’t enough – you need strategic partnerships, focused expertise, and patience to build trust in conservative markets. While the timeline may be longer than typical startup trajectories, the approach creates defensible advantages that persist even after the technology becomes mainstream.

Actionable

Takeaways

Focus on Specialization to Stand Out:

Daniele emphasized the importance of specializing in a niche area, like Axyon AI has done with AI for financial markets. This specialization not only differentiates a business from competitors but also builds deeper expertise that can be more compelling to potential clients within that niche.

Build a Strong Technological Foundation:

In AI and other tech-centric fields, having a solid technological and scientific foundation is crucial. This rigor helps in building trust, especially in industries like finance where the stakes are high and the margin for error is low.

Leverage Local Ecosystems for Global Impact:

Axyon AI's decision to base operations in Modena, an area with a strong engineering heritage due to its automotive industry, highlights the advantage of tapping into local expertise and infrastructure, even for a seemingly unrelated field like AI.

Educate Your Market:

Daniele faced initial challenges in educating potential users and investors about AI's capabilities and benefits. Startups should invest in educating their target market, particularly when introducing innovative or disruptive technologies.

Use High-Profile Advisors to Gain Credibility:

Engaging with well-known advisors or securing investments from respected figures can lend credibility and facilitate easier entry into tightly-knit industry circles, as Daniele's experience with Axyon AI shows.