Ready to launch your own podcast? Book a strategy call.

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Conversation

Highlights

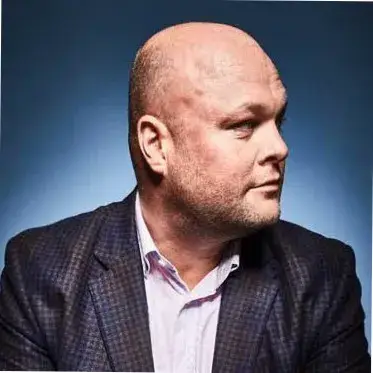

From Selling Christmas Presents at Age 7 to Building a $1B Commerce Infrastructure: Sean Henry’s Stord Journey

In a recent episode of Centaur Builders, Sean Henry, founder and CEO of Stord, shared the remarkable story of how he built a commerce enablement platform that rivals Amazon’s logistics capabilities—all before his 25th birthday.

Henry’s entrepreneurial journey started unusually early. “The first time I ever sold a product online was in 2003 when I was 7 years old,” Sean recalls. “Thankfully I was able to open an eBay account and sell my Christmas presents as I really wanted something else than what I got for Christmas.”

This early experience sparked a passion for e-commerce that would eventually lead to the creation of Stord, a company that now operates 11 warehouses across North America with over 3 million square feet of space.

The Origin Story: Two 18-Year-Olds Taking on Amazon

By the time Sean was 18 and in college, he had accumulated over a decade of experience selling products online. Throughout this journey, he repeatedly encountered a critical pain point: as an independent brand, he couldn’t compete with Amazon’s fulfillment capabilities.

“Throughout all of those experiences I just kept feeling the pain point of being an independent brand and having to manage my own supply chain and competing against giants like Amazon who are setting standards like next day or same day free delivery,” Sean explains.

When he founded Stord in 2015 with his co-founder, they faced an immediate challenge: how could two teenagers with minimal capital create an Amazon-level logistics network?

Their solution was ingenious. Rather than attempting to build warehouses from scratch, they created a network of partner facilities—essentially becoming the “Airbnb of warehousing.”

“What if we call warehouses across the US, kind of like Airbnb or Uber or somebody else and say, ‘hey, we’ll stock product in your building asset light and build the software layer on top so that we can build a more nimble network,'” Sean recounts.

The Wedge Strategy

Instead of trying to replicate Amazon’s entire infrastructure immediately, Sean and his team identified the critical component that drove logistics success: inventory placement.

“Day one, we kind of stepped back and said, if we want to deliver this Amazon-like value proposition to brands, what is the most unique element of their operation and their supply chain? And it’s how they place inventory across a network close to consumers to mitigate shipping costs and enable fast speeds.”

This approach became their wedge into the market. By solving this specific problem exceptionally well, they could build credibility and volume before expanding to other logistics capabilities.

From Warehousing to Commerce Enablement

What began as a warehousing solution has evolved into a comprehensive commerce enablement platform. Today, Stord manages the entire physical journey of products—from manufacturing to delivery to returns—along with the software that orchestrates this process.

“From the time you manufacture a product to deliver it to a consumer and return it—all the physical end to end and software to support that journey is our product offering today,” Sean says.

This expansion required a long-term vision and the ability to convince investors that Stord could be what Sean calls “a multi-product compounder.”

“We had to talk a lot to investors about why this is a wedge in our eventual product strategy. And while the real bet on Stord is can we be a multi-product compounder, a very entrepreneurial business within itself.”

The Cost Center to Value Engine Transformation

Perhaps Stord’s most powerful go-to-market insight was recognizing that shipping and fulfillment represent an inevitable cost for brands—one that could be transformed from a burden into a competitive advantage.

“Our best sales pitch ever to a brand is listen, you’re going to spend 10 to 15% of your revenue on your end to end shipping, fulfillment returns and all the software to try to manage that no matter what,” Sean explains. “Let us take that from you and take it from being a fragmented, clunky cost center where you are shipping too slow, spending too much and under delighting your end consumers, to a value engine.”

This approach positions Stord not as an additional expense but as a way to optimize an existing, unavoidable cost while improving customer experience.

The Wide Aperture Strategy

Unlike many startups that begin with a hyper-focused ideal customer profile (ICP), Stord initially took a broader approach. Sean explains their unconventional strategy:

“Instead of focus on just defining the super narrow ICP to start and saying that’s only who we’re going to serve and build for, let’s actually start with a wide aperture. A lot of people look for the smallest market for product, market fit. We really just started with a wider aperture.”

This approach was particularly effective for Stord’s business model, which benefits from network effects—more volume means lower costs and faster delivery times. As the business scaled, they gradually narrowed their focus to brands doing $10+ million in revenue, primarily in nutrition, supplements, health and beauty, apparel, and accessories.

Founder-Led Sales: A Competitive Differentiator

As Stord has grown, one principle has remained consistent: the power of executive involvement in sales. Even today, with hundreds of millions in revenue, Sean personally participates in over half of the company’s deals.

“Every deal at Stord has a named executive sponsor, where early in the cycle they’ll reach out to the executives at our company,” Sean reveals. “It doesn’t feel the most scalable. But then you step back as a founder and you go, okay, if 50% of my valuation or my business is driven by growth, how much time am I really investing in growth?”

This approach creates a key competitive advantage. As Sean notes, “I just talked to two founders this morning… and both of them reference it’s the exact team engagement that was the game changer for them to say, this is the business I want to work with.”

The Future Vision: Reverse Engineering Amazon

Looking ahead, Sean sees Stord as “reverse engineering Amazon”—building from the backend logistics infrastructure rather than from a consumer marketplace.

“Act one for us was really build that prime-like delivery network. Act two is really build all the software needed to power our brands and all the business tools they need. And then Act 3 is really win the consumers and build a brand that the consumers trust.”

This long-term vision could eventually lead to a subscription service where consumers pay for guaranteed fast delivery across all Stord’s partner brands—echoing Amazon Prime but built to empower independent brands rather than a single retail giant.

Sean Henry’s journey from selling Christmas presents at age 7 to building a billion-dollar logistics platform demonstrates how identifying a critical infrastructure gap and solving it systematically can create enormous value. By transforming an inevitable cost center into a strategic advantage, Stord has carved out a unique position in the future of commerce infrastructure.

Actionable

Takeaways

Start with a wedge product, then expand:

Stord began by tackling one critical component of the supply chain—warehouse placement—before expanding to a full-stack solution. Sean explains, "Day one, we kind of stepped back and said, what is the most unique element of [Amazon's] operation and their supply chain? And it's how they place inventory across a network close to consumers to mitigate shipping costs and enable fast speeds." B2B founders should identify a specific high-impact problem, solve it exceptionally well, and use it as a platform for broader expansion.

Turn cost centers into value engines:

Stord's most effective pitch is showing brands how to transform an inevitable cost (shipping and fulfillment) into a competitive advantage. Sean shared, "Our best sales pitch ever to a brand is, 'You're going to spend 10 to 15% of your revenue on your end-to-end shipping, fulfillment, returns... Let us take that from you and take it from being a fragmented, clunky cost center where you are shipping too slow, spending too much... to a value engine.'" B2B founders should focus on transforming existing, unavoidable expenses into strategic assets rather than creating entirely new cost categories.

Evolve your ICP strategically:

Stord initially cast a wide net to gain volume, then narrowed their focus as they scaled. Sean advises, "Let's actually start with a wide aperture... We want to handle anyone who agrees with the problem we're solving and can get volume flowing in our network." For flywheel businesses that depend on scale, B2B founders should consider prioritizing early volume over extreme ICP precision, then refine as they grow.

Commit to executive-led sales:

Stord attributes much of their growth to founder and executive involvement in sales. "Every deal at Stord has a named executive sponsor... It doesn't feel the most scalable. But then you step back as a founder and you go, okay, if 50% of my valuation or my business is driven by growth, how much time am I really investing in growth?" B2B founders should institutionalize executive involvement in key deals rather than fully delegating this crucial function too early.

Map and measure customer ROI meticulously:

Stord focuses intensely on documenting specific ROI metrics for each customer. Sean cautions, "If we don't have a specific ROI mapped out for them... if we don't know every time we look at them, this is the feature and ROI they're getting the most... we should consider them pre-churn because they will leave." B2B founders should develop robust ROI tracking systems that demonstrate their solution's specific value to each customer.