Ready to launch your own podcast? Book a strategy call.

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Conversation

Highlights

Building Trust in Fintech: Finally.com’s Unconventional Path to SMB Finance Automation

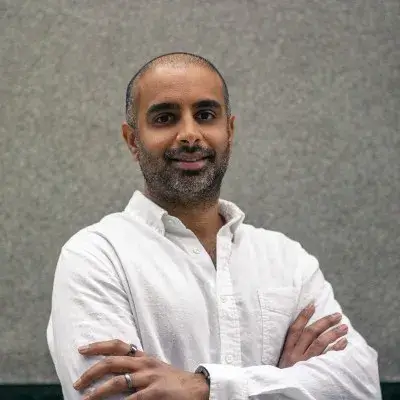

When Felix Rodriguez set out to acquire the Finally.com domain for his finance automation platform, he faced what seemed like an impossible challenge. The domain was owned by a successful entrepreneur who had already taken a company public and sold it to Yahoo. Money alone wouldn’t be enough to secure the deal. Instead of a traditional transaction, Felix took an unexpected approach: he pitched the vision of his company directly to the owner.

“I had to get on the phone with him and pitch him the vision, the idea, and I sold him on the vision of finally you can get everything in one place in terms of your finances and all your back office in front office that you need to run your business,” Felix explains. The strategy worked – not only did Felix secure the domain, but the previous owner became an advisor and shareholder in the company.

This story exemplifies Finally.com’s broader approach to building a finance automation platform: focusing on vision, team building, and relentless execution. With over $110 million in funding, the company has grown from speaking with 20-30 potential customers per month to engaging with over 1,000 businesses monthly.

The Evolution of Building B2B Software

Having founded multiple companies since 2003, Felix has witnessed firsthand how building B2B software has transformed. In the early 2000s, the lack of APIs meant building everything from scratch. “I don’t think people knew what an API was. So if you’re building anything, chances are you’re probably building all of it yourself,” Felix recalls. “You’re taking like, non technology and archaic ways of doing things and try to build technology on top of it.”

This experience shapes Finally’s current approach to product development. The company started with AI capabilities five years ago, before the widespread availability of transformers and LLMs. Today, they maintain a dedicated AI engineering team working on proprietary models like Prometheus, giving them an edge over traditional financial service providers.

The Sales-Led Growth Engine

While many fintech companies focus purely on product-led growth, Finally has found success in building a robust inside sales operation. Felix maintains that being the first sales representative is crucial for founders: “I feel like if I could sell it myself, if I could solve someone’s pain, then I can help teach others what’s resonating in the market and with customers.”

This hands-on approach to sales has helped Finally develop both their product and their go-to-market strategy. Even now, as CEO, Felix still participates in larger deals to stay connected with customer needs. As he puts it, “You got to sell the product, you got to sell the vision, you got to sell new recruits, you got to sell investors, you got to sell your vision continuously. You’re never going to stop.”

Vertical-Specific Messaging in a Multi-Product Platform

One of Finally’s key learnings has been the importance of tailoring their messaging to specific verticals, despite having a broad product offering that includes bookkeeping, expense management, corporate cards, bill pay, invoicing, and payroll. Felix illustrates this with a practical example: “A dentist probably doesn’t care about, like, invoicing. They don’t invoice consumers that come in for their dental work. So definitely don’t send a dentist messaging about sending invoices.”

The Fintech Challenge

For founders looking to enter the fintech space, Felix offers a counterintuitive piece of advice: don’t start with fintech. “I’d probably start with some kind of software and then figure out how to layer fintech in. Just because fintech, it’s very costly and takes a lot of time, rightfully so.”

Instead, he recommends focusing first on customer acquisition: “What you really should be focused on is ways of getting customers. You can figure out how to get customers… pipeline over everything. Then you can build something long term.”

This approach reflects Finally’s own journey of balancing speed with regulatory requirements. As Felix notes, “If it was just AI and SaaS, you’d go super fast. Super, super fast. But the minute you throw in some fintech stuff, adds complexity and regulatory stuff and compliance things.”

Looking Ahead

Finally’s vision extends beyond just providing financial tools. They aim to bring “simplicity back” to small business operations, allowing business owners to focus on their core competencies rather than juggling multiple software solutions. With their combination of AI capabilities, comprehensive financial services, and vertical-specific approach, they’re working to become what Felix describes as a “platform of platforms” for SMB finance.

For B2B tech founders, Finally’s journey offers valuable lessons in the importance of vision-driven sales, the balance between product and sales-led growth, and the strategic advantages of starting with core software capabilities before expanding into regulated spaces like fintech.

Actionable

Takeaways

Customer-Centric Messaging:

Tailor your marketing messages to the specific needs of different customer segments to improve conversion rates and reduce CAC.

Test and Iterate:

Treat marketing efforts as experiments. Always be testing various channels and approaches to find what works best for your audience.

Founder-Led Sales:

As a founder, leading the initial sales efforts can provide valuable insights into customer pain points and help refine the product and sales process.

Combine Software and Fintech:

For new fintech ventures, consider starting with a software solution and layering fintech elements later to manage costs and regulatory complexities.

Focus on Pipeline:

Prioritize building a strong pipeline of potential customers. Consistent and robust customer acquisition strategies are crucial for long-term success.