Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Conversation

Highlights

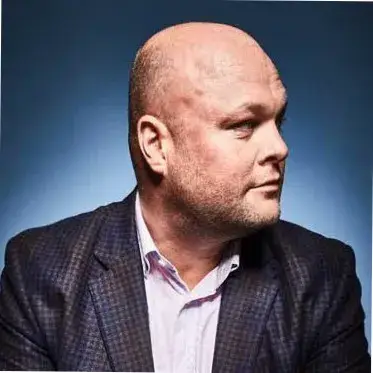

In our latest episode of Unicorn Builders, we speak with Arik Shtilman, CEO and co-founder of Rapyd, the pioneer of the fintech-as-a-service category. With $800 million raised at a $15 billion valuation, Rapyd is one of the largest private companies in tech. Here are the top actionable takeaways from our conversation.

#1: Turn rejection into rocket fuel.

“When we actually were building Rapyd, everybody told me, you cannot do that. It’s not the way the industry works. It’s too big. It’s impossible to be something that is global. And we proved everybody wrong again and again. But the best one that I love the most is actually an email that I got from an investor when we started this company that decided to skip the investment in Rapyd because he said, and I have it in writing and framed in my office, because I’m missing the skills of a founder to raise capital. But I raised almost a little bit more than $800 million overall in this time frame. And he invested at the end, but I still have the email.

“It fuels you. You need something to fuel you. And it can’t only increasing revenue. It cannot like these small things. Okay, fine, I will double the revenue. But actually, proving people that are wrong, it’s wow.

💡Actionable takeaway: Rejection is inevitable but how you respond to that rejection is a choice. Some let rejection and criticism break them while the greats, use that rejection to fuel them.

#2: Use controversy to your advantage.

“Let’s go back to 2021, right? Rapyd is a company with around 150 people, maybe 120 people. Everybody in tech is recruiting engineers like crazy. We know that we need to recruit huge amount of people. We need to recruit, like, 300 engineers in, like, six, eight month time frame, which is basically Mission Impossible.

Myself and my co-founder were thinking about, okay, what are we going to do? And we just signed the new office list and we came to the conclusion, you know what, as part of the office opening, let’s do a huge party. Let’s bring Tiesto and David Guetta to play.

And I told him, you know what, it’s going to create a lot of noise because it’s COVID and there are no parties and it’s Tiesto and David Guetta and everybody wants to see it. And we said, okay, let’s do it. And we did it. It cost us money. But what happened very quickly is that everybody knew about the company. Like, it exploded in milliseconds.

Everybody knew who Rapyd is. Everybody knew about a party. Everybody wanted to get tickets. And were able to recruit the 300 engineers in six months with a cost of average cost of recruitment of around $2,000 instead of like $35,000. And it paid back. Every single cent paid back. And it was the smartest move that we’ve done. From a recruitment and brand recognition perspective, it was like explosion that everybody knows us. And yes, we got a lot of bad publicity, especially from competitors that didn’t like the fact that we used these type of tools in order to get brand awareness and recruitment. But hey, we don’t care. It works for us, so it’s fine.”

💡Actionable takeaway: You will never rise above the noise if you are boring. You never want to jeopardize your brand but you should never be afraid of pulling off big marketing campaigns that aim to get people talking.

#3: Stay in the details.

“My superpower is that I’m always in the details. I’m super familiar with the product up until now. I can tell you about the code that is written in a specific area, even though there are like 500 engineers that work here. I know trends of clients. I like data and I like to be very data oriented. And I really like to meet in my week not only my executive team and to see spreadsheets. I want to meet the actual people that do the work, the support team, the compliance operations team. I want to know what’s going on.

💡Actionable takeaway: Regardless of how big and successful your company becomes, never become too removed and disconnected from the product and people who are in the trenches.

#4: One meeting can change everything.

“I announced to the employees that I’m shutting the company down and I’m closing it in 2017. I called all the employees and I told them, listen, guys, we’re shutting down in three months. Send your resumes. I have money to pay for three more months. We’ll give it another shot. I have one more meeting to take. It is tomorrow, and if it’s not going to work, then we’re done.

I went to meet the guy that manages the fund and I sat down with them in a coffee shop, not even an office, and he asked me, what are you trying to do? And I was thinking to myself, okay, I’m going to explain to him what I’m trying to do. And there was a currency exchange booth right in front of the coffee shop. So I told him, you see this? I want to take them out of business. So the guy looks at the other guy, tells him, give him $5 million stand ups and walks out of the meeting. They made $1.5 billion from that investment.”

💡Actionable takeaway: In your darkest moments, never forget that you are one meeting away from a potential breakthrough that can change everything.

#5: Get your narrative right.

“We could not raise capital for this company because were not able to articulate simply, what the hell what do we do? Like, every single meeting we had was, oh, we build this infrastructure for moving money in and money out. And it’s like an international network. And it’s like, investors don’t like to hear this bullshit. They don’t have the patience. They hear 800 companies a year, everything sounds the same.

We came out from a meeting again, failed completely to explain. And I remember going down an elevator with my co founder and I was telling him, I do not understand why these idiots cannot get what we do. It’s very simple. It’s like Amazon AWS but for fintech.

And suddenly we looked at each other and we said, yes, that is the elevator pitch. That is the story! And this is how Fintech as a service was born. Because my CMO told me, you cannot write AWS for Fintech because AWS is something else. But we can say Fintech as a service, which is basically cloud computing or whatever you want to call it, as a service. And this is how it was born. And from that moment that were able to articulate AWS of Fintech, aka Fintech as a service, went from raising 5 million to raising more than 780 something million.

💡Actionable takeaway: You may have the most amazing and innovative product in the world but if you cannot articulate what you do in simple terms, you will fail. Take the time to really dial in your story and simplify how you explain what you do.

#6: Invest in brand awareness.

“Invest money in brand awareness and build a brand as early as possible. A lot of times people think that the brand, they can invest in it later. They need to invest in marketing in order to generate leads, in order to do online acquisition, whatever it is. But they don’t understand that. The most complicated thing when you do a sale is to have brand awareness because it reduces the friction. So invest super early in a brand. Now, a brand is not a logo. A lot of times people think that, brand is my logo, brand is the color, brand is the website. No, a brand is a lot of different parameters is the logo, is the website, it’s the colors, it’s how you talk about the company, it’s how you present the company, it’s how people interact with the company. It has so many different elements. I strongly recommend founders to invest in brand awareness as early as they can, because building brand takes time. It’s not like, okay, I have a $50 million, I will get a brand overnight. No, it doesn’t work this way. You need to build it slowly and gradually from the beginning of the company.”

💡Actionable takeaway: Many early stage founders put off brand building. They say they are too early, they will worry about that down the road. The reality is that brand building takes a long time. Founders should begin brand building as early as possible in their journey.

#7: Understand the ROI of awareness.

“Measuring the ROI of brand awareness is very simple: by the way it reduces the sales cycles. It reduces the amount of lost deals. Because at the end, when you go and pitch a new SaaS product to a company that never heard your name, by definition, you’re going to fail. And you have a small chance to succeed. But if they know you already, they know the name, they know who is the company in general. Forget about the product. Your starting point is dramatically better, by the way. It’s like in dating, when you meet a man, a woman, whatever it is, you need a better starting point in order to have higher chances. And that’s exactly the story. You can easily show an ROI of brand awareness. Easily.”

💡Actionable takeaway: Brand awareness is all about creating a better starting point for your discussions with customers, investors, talent, and partners. If they’ve never heard of you before, you are at an immediate disadvantage.

#8: Be motivated by a big personal vision.

“At the end of the day, the main thing that pushes me is the fact that I want to make enough money in this entire thing in order to buy my favorite basketball team and to want the team now, people need to understand that European basketball, which is my real passion, is not the NBA. So when you buy a team, you need to finance the team for years because it cannot make money. So every single cent, every single player you sign or whatever it is, it’s going to cost you money from your own personal pocket because the teams are not profitable. So you need a lot of money to want a good team. So that’s the only thing that pushes me.”

💡Actionable takeaway: Building a company is a marathon. Hitting revenue targets and other milestones will not be enough to keep you motivated for the years and potentially decades it will take in order to be successful. Look for something bigger and deeper that can keep you motivated through the highs and lows of building a successful company.